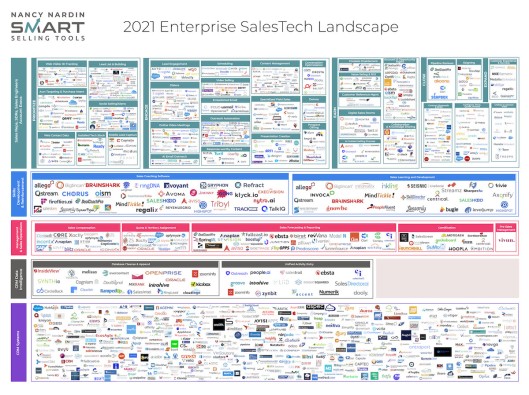

Here is a great overview of where we are with Sales and Marketing technology.

Just last month, I wrote that salestech is the new martech, and that it’s supercharging both professions. Here’s more data to support that case.

First, the 2021 Enterprise SalesTech Landscape above, produced by Nancy Nardin of Smart Selling Tools, was released last week. It now features 1,078 solutions across 45 unique categories.

It reminds me of when the 2014 Marketing Technology Landscape hit ~1,000 companies. It was a real inflection point in the martech industry — both for investors and startups, who started to pour into the space, and for marketers, who began to take martech seriously as a major pillar of their department.

(A month later, I wrote What if 1,000+ marketing technology vendors were the new normal? — which seemed outlandish to most people at the time. Of course, now that we are up to 8,000 martech solutions and climbing, that prediction seems rather quaint in hindsight.)

Is 1,000+ salestech solutions the new normal now too?

My bet: yes.

I wrote a lot last year about The Great App Explosion and how platform dynamics are driving simultaneous app expansion and platform consolidation in martech. I believe those same dynamics apply to salestech as well.

But that’s mostly a supply-side view. What about the demand side? Why are sales teams suddenly embracing so many new apps?

Arguably for the same reason marketers ended up embracing so many martech tools: their profession has changed to be weighted much more toward digital interactions. In a digital world, apps are the tools of your trade.

And 2020 gave us quite a crash-course in digital selling.

Source: More evidence that the Golden Age of Salestech has arrived – Chief Marketing Technologist